India hikes customs duty for lithium-ion batteries from 10% to 20%

India Hikes Customs Duty for Lithium-Ion Batteries from 10% to 20%

Introduction to India's Lithium-Ion Battery Market Dynamics

India has recently announced a significant revision of its import tariff structure for lithium-ion batteries, increasing the customs duty from 10% to 20%. This strategic move represents a calculated effort by the Indian government to bolster domestic manufacturing capabilities and reduce reliance on imported battery technologies. The decision arrives at a critical juncture when India is aggressively pursuing its ambitious goals of achieving 30% electric vehicle penetration by 2030 and establishing itself as a global hub for renewable energy storage solutions. This tariff adjustment is expected to have far-reaching implications for both international battery manufacturers and domestic producers, potentially reshaping the entire energy storage landscape in South Asia. The policy change reflects a broader pattern of economic strategies aimed at enhancing India's self-sufficiency in critical technology sectors while simultaneously addressing trade imbalances with partner nations. As the world transitions toward cleaner energy systems, India's approach to managing its battery supply chain will undoubtedly influence global market dynamics and investment patterns in the renewable energy sector.

The government's decision to raise import duties aligns with its broader "Make in India" initiative, which seeks to promote domestic manufacturing across various sectors. This protectionist measure is designed to provide local battery manufacturers with a competitive advantage against imported products, particularly those originating from China, which currently dominates the global lithium-ion battery market. However, this policy shift also presents significant challenges for Indian companies that rely on imported batteries for their products, potentially increasing production costs in the short to medium term. The automotive industry, which is rapidly transitioning toward electrification, will be particularly affected by this change, as battery packs constitute a substantial portion of an electric vehicle's total cost. Industry stakeholders are now carefully evaluating the long-term implications of this policy on their business strategies and supply chain configurations.

Historical Context of India's Battery Import Policies

India's approach to regulating lithium-ion battery imports has undergone several transformations over the past decade, reflecting the government's evolving strategy toward energy storage and electric mobility. Prior to the recent increase, the basic customs duty on lithium-ion cells and batteries stood at 10%, a rate that had been maintained to balance the needs of domestic manufacturers against the requirements of industries dependent on imported battery technology. In February 2021, the Indian government implemented a comprehensive revision of its tariff structure, affecting over 30 product categories, but made only minor adjustments to battery-related duties at that time3. The 2021 budget introduced a 2.5% duty on inputs and raw materials for lithium-ion batteries while maintaining higher duties on finished products, demonstrating an early intent to encourage domestic value addition7.

The historical trajectory of India's battery import policies reveals a gradual shift from open market access toward strategic protectionism. This transition has been motivated by growing concerns over energy security, trade deficits, and the strategic importance of establishing a domestic battery manufacturing ecosystem. Between 2019 and 2025, the government launched several initiatives to promote local battery production, including a ambitious plan to develop 50 GWh of lithium-ion battery manufacturing capacity through targeted incentives and subsidies5. The production-linked incentive (PLI) scheme for advanced chemistry cell battery storage further demonstrated the government's commitment to attracting investments in domestic battery manufacturing facilities. These historical policy measures have progressively created a foundation for the recent tariff increase, which represents the most assertive step yet in India's strategy to build a self-reliant battery industry.

Table: Evolution of India's Lithium-Ion Battery Import Duties

| Year | Customs Duty Rate | Key Policy Measures | Strategic Objectives |

|---|---|---|---|

| 2019 | 10% | National Mission on Transformative Mobility and Battery Storage | Encourage initial market development |

| 2021 | 10% (with 2.5% on components) | Phased Manufacturing Program | Promote gradual localization |

| 2023 | 15% | PLI Scheme for ACC Battery Storage | Attract domestic manufacturing investments |

| 2025 | 20% | Revised customs duty structure | Enhance domestic production competitiveness |

Implications for Domestic Battery Manufacturing Sector

The increased customs duty on lithium-ion batteries is expected to generate significant opportunities for India's domestic battery manufacturing industry. By making imported batteries more expensive, the policy effectively creates a protected market environment where local manufacturers can compete more effectively without facing overwhelming price competition from established international suppliers. This protection is particularly crucial given the early stage of India's battery manufacturing ecosystem, which requires time and market stability to achieve economies of scale and technological maturity. The tariff adjustment provides domestic manufacturers with the pricing power necessary to justify substantial investments in production facilities, research and development, and workforce training. Industry leaders such as Exide Industries, Amara Raja Batteries, and new entrants like Ola Electric are likely to benefit from this enhanced protection, potentially accelerating their plans for capacity expansion and technology development.

However, the domestic industry also faces formidable challenges that the tariff alone cannot address. India's battery manufacturing sector suffers from a critical dependency on imported raw materials, particularly lithium compounds, cathode materials, and battery-grade specialty chemicals. Currently, approximately 80% of the global lithium processing capacity is concentrated in China, creating significant supply chain vulnerabilities for Indian manufacturers2. The increased import duty on finished batteries may inadvertently exacerbate this dependency if domestic production cannot scale up rapidly enough to meet growing demand. Industry experts have pointed out that establishing a complete battery manufacturing ecosystem requires coordinated investments across the value chain, from mineral processing to cell manufacturing to pack assembly. Mr. R.C. Bhargava, Chairman of Maruti Suzuki India, has emphasized that "the uncertainty in lithium resource supply chains represents a fundamental obstacle to developing India's battery manufacturing sector"2. Without parallel efforts to secure raw material supplies and develop local technical capabilities, the higher tariffs might simply transfer import dependency from finished batteries to battery components and materials.

Impact on Electric Vehicle Adoption and affordability

The increase in lithium-ion battery import duties presents a complex challenge for India's electric vehicle industry, which is heavily dependent on imported battery technology. In the short term, this policy is likely to increase the cost of electric vehicles manufactured in India, as automakers either pay higher duties on imported battery packs or source more expensive domestic alternatives. This cost pressure comes at a critical time when the Indian government is trying to accelerate EV adoption through various subsidies and incentives. The contradiction between protectionist industrial policy and adoption-friendly market policy creates a delicate balancing act for policymakers and industry stakeholders alike. Electric two-wheelers, which represent the largest segment of the Indian EV market, are particularly sensitive to cost increases, and even a modest price hike could dampen consumer demand in this price-conscious segment.

Despite these short-term challenges, the long-term perspective suggests that localizing battery production could ultimately reduce costs and enhance the sustainability of India's electric mobility transition. The current dependency on imported batteries exposes Indian EV manufacturers to currency fluctuations, global supply chain disruptions, and geopolitical tensions that could jeopardize the steady supply of essential components. By encouraging domestic battery production, the new tariff structure aims to create a more resilient supply chain that is less vulnerable to external shocks. Several automotive industry leaders have acknowledged the necessity of this transition while emphasizing the need for complementary policies to mitigate short-term disruptions. The government is expected to respond by enhancing demand-side incentives such as the Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme to maintain adoption momentum while the domestic battery industry matures. This coordinated approach recognizes that successful electric vehicle adoption requires both a supportive market environment and a secure, cost-competitive supply chain.

Table Projected Impact of Battery Duty Increase on EV Segments

| Vehicle Segment | Current Battery Import Dependency | Short-term Cost Impact | Long-term Supply Chain Development |

|---|---|---|---|

| Electric Two-wheelers | 85-90% | 3-5% price increase | Moderate benefit due to scaling |

| Electric Cars | 75-80% | 4-7% price increase | Significant benefit from localization |

| Electric Buses | 60-70% | 2-4% price increase | Strong benefit due to production links |

| Energy Storage Systems | 90-95% | 5-8% price increase | Gradual benefit as capacity expands |

Renewable Energy Storage and Grid Stability Implications

The increased customs duty on lithium-ion batteries extends beyond the automotive sector to affect India's renewable energy ambitions, particularly in the area of grid-scale energy storage. Battery storage systems (BESS) are increasingly critical for integrating variable renewable energy sources like solar and wind into the grid, providing stability, and ensuring reliable power supply. The tariff increase on imported batteries may temporarily slow down the deployment of large-scale energy storage projects by increasing their capital costs. This development could have implications for India's renewable energy roadmap, which targets 450 GW of renewable capacity by 2030 and requires substantial energy storage to effectively manage this intermittent generation. Project developers and power utilities are now reassessing the economics of planned storage projects, with some potentially facing delays or requiring additional financial support to remain viable.

Despite these short-term challenges, the policy change creates significant opportunities for developing a domestic energy storage manufacturing industry. India's battery storage market is projected to grow to 300 GWh by 2025, representing a massive opportunity for local manufacturers5. The new tariff structure improves the business case for establishing local battery production facilities dedicated to serving the energy storage market. Various technology options are being explored, including lithium-ion, sodium-ion, and flow batteries, each with different cost structures and performance characteristics. As of 2025, the cost of lithium-ion BESS in India is estimated to be approximately ₹18,000-₹22,000 per kWh for grid-connected systems6. The government is supporting this transition through subsidies like the Viability Gap Funding (VGF) scheme, which covers 20-40% of project costs for eligible energy storage developments6. These complementary measures aim to ensure that India's renewable energy transition remains on track while simultaneously building domestic manufacturing capabilities in this critical sector.

Global Trade Relationships and International Responses

India's decision to increase import duties on lithium-ion batteries must be understood within the broader context of its international trade relationships, particularly with the United States and China. In March 2025, just before announcing the battery tariff increase, India eliminated import duties on 35 components used in electric vehicle batteries and 28 items critical for mobile phone manufacturing18. This simultaneous reduction of duties on raw materials and increase on finished products demonstrates a sophisticated approach to industrial policy that seeks to encourage domestic value addition while maintaining access to essential inputs. The timing of these changes is significant, as they come amid ongoing trade negotiations with the United States, which had threatened reciprocal tariffs on Indian goods8. By offering to reduce tariffs on over 50% of U.S. imports worth $23 billion while increasing protection for strategic sectors like battery manufacturing, India is pursuing a nuanced trade strategy that balances multiple objectives8.

The international response to India's battery tariff increase has been mixed, reflecting the complex interplay of economic interests in the global battery market. Chinese battery manufacturers, who currently dominate the global supply chain, have expressed concern about reduced access to the rapidly growing Indian market. Meanwhile, American and European battery technology companies have shown increased interest in establishing manufacturing partnerships in India to circumvent the higher tariffs. This response aligns with India's broader objective of positioning itself as an alternative manufacturing hub in the "China Plus One" diversification strategy being pursued by many multinational corporations4. The Indian government has actively encouraged international battery manufacturers to establish local production facilities through various incentive programs, including tax benefits, production-linked incentives, and now tariff protection. This approach has already yielded some successes, with several international companies announcing plans to set up battery manufacturing operations in India. The long-term effectiveness of this strategy will depend on India's ability to create a competitive business environment that offers genuine advantages over established manufacturing locations in East Asia.

Future Outlook and Strategic Recommendations

The increase in India's customs duty for lithium-ion batteries from 10% to 20% represents a strategic bet on the country's ability to develop a competitive domestic battery industry within a protected market environment. The success of this policy will depend on several factors, including the pace of technological learning, the availability of raw materials, the development of supporting infrastructure, and the continued growth of demand for batteries in electric vehicles and energy storage applications. Industry analysts project that if the policy achieves its objectives, India could develop 50 GWh of domestic battery manufacturing capacity by 2030, significantly reducing import dependency and creating a self-sustaining battery ecosystem5. However, realizing this vision will require coordinated action across multiple policy domains, including mineral security, technical education, research and development, and international partnerships.

Based on the analysis of India's battery industry challenges and opportunities, several strategic recommendations emerge for both policymakers and industry participants. First, India should accelerate efforts to secure critical mineral resources through diplomatic channels, strategic partnerships, and investment in domestic exploration and extraction. Second, the government should enhance support for battery research and development, particularly in alternative chemistries like sodium-ion that might offer advantages given India's resource endowment. Third, policymakers should consider implementing complementary measures to support market development, such as extending and expanding the FAME scheme for electric vehicles and creating dedicated incentives for energy storage deployment. Fourth, industry participants should pursue strategic partnerships and technology transfer agreements with international leaders to accelerate capability development while reducing dependence on imported raw materials through recycling and material innovation. Finally, all stakeholders should recognize that building a competitive battery industry is a long-term endeavor that requires patience, persistence, and continuous policy support despite inevitable short-term challenges and setbacks.

In conclusion, India's decision to increase customs duty on lithium-ion batteries from 10% to 20% represents a bold industrial policy move with far-reaching implications for the country's energy security, economic development, and environmental goals. While the policy creates short-term challenges for downstream industries that depend on imported batteries, it offers the potential for long-term benefits through the development of a domestic manufacturing ecosystem that creates jobs, reduces import dependency, and enhances technological capabilities. The ultimate success of this policy will depend on its careful implementation within a broader package of measures designed to address the multiple challenges facing India's emerging battery industry. If successful, this approach could establish India as a significant player in the global battery market while supporting its ambitious goals for electric mobility and renewable energy integration.

-

May.2026.01.20A&S Power Technology Co., Limited Exhibits at Tokyo Big Sight 2026Learn More

May.2026.01.20A&S Power Technology Co., Limited Exhibits at Tokyo Big Sight 2026Learn More -

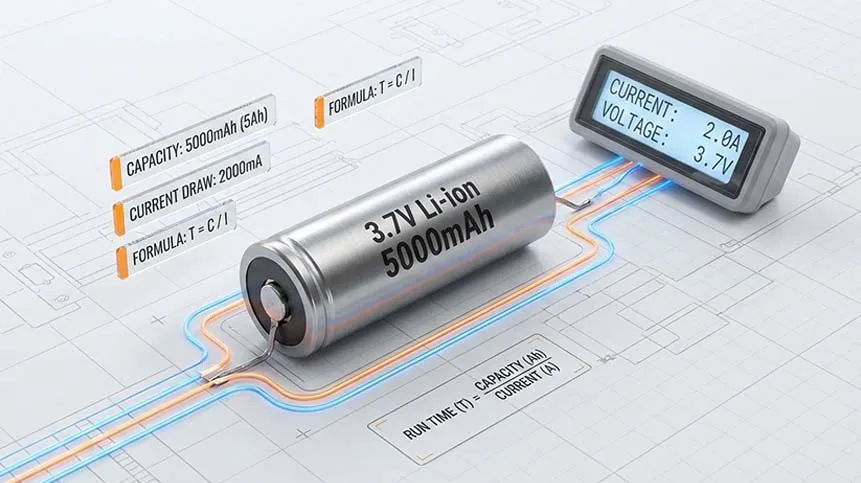

May.2026.01.19How to Calculate Battery Run Time?Learn More

May.2026.01.19How to Calculate Battery Run Time?Learn More -

May.2026.01.19What Is Better, Lithium Ion or Polymer?Learn More

May.2026.01.19What Is Better, Lithium Ion or Polymer?Learn More -

May.2026.01.19What Is a Rechargeable Li-ion Battery: Complete Guide & Industry InsightsLearn More

May.2026.01.19What Is a Rechargeable Li-ion Battery: Complete Guide & Industry InsightsLearn More -

May.2026.01.16Lithium Manganese Dioxide Battery Ultimate GuideLearn More

May.2026.01.16Lithium Manganese Dioxide Battery Ultimate GuideLearn More