Price Trend for Rechargeable Lithium Battery

You see a significant shift in the price trend for rechargeable lithium batteries. Recent industry reports show:

- The average price per kWh for lithium batteries stands at $115 as of December 2024.

- This marks a 20% drop from last year.

- Electric vehicle battery prices have now fallen below $100 per kWh.

Understanding these trends helps you make informed decisions in a rapidly changing market. By tracking lithium battery price changes, you position yourself to respond to shifts in supply, technology, and demand.

Key Takeaways

- Lithium battery prices have dropped significantly, with the average cost per kWh at $115 in December 2024, a 20% decrease from the previous year.

- Electric vehicle battery prices have fallen below $100 per kWh, making EVs more affordable and boosting demand for clean transportation.

- Tracking lithium battery price trends helps you make informed purchasing decisions, allowing you to respond to market shifts effectively.

- Raw material costs, manufacturing advances, and government policies are key factors influencing lithium battery prices.

- Future forecasts suggest continued price declines, with expectations of prices reaching around $100 per kWh by 2025 and between $32 to $54 by 2030.

Current Price Trend

Latest Price Data

You see rapid changes in the price trend for rechargeable lithium batteries. The latest market research shows that the average price per kWh for lithium batteries reached $115 in December 2024. This price reflects a significant drop compared to previous years. You notice that electric vehicle battery prices have now fallen below $100 per kWh, making EVs more affordable for many buyers.

Recent monthly price trends reveal important shifts in the lithium battery market. You can review the following key data points:

- As of September 2025, the price of lithium metal in Northeast Asia stands at 9.53 USD/Kg.

- This price marks a 10.5% increase compared to previous months.

- Rising demand from the electric vehicle battery sector and supply-side constraints drive this increase.

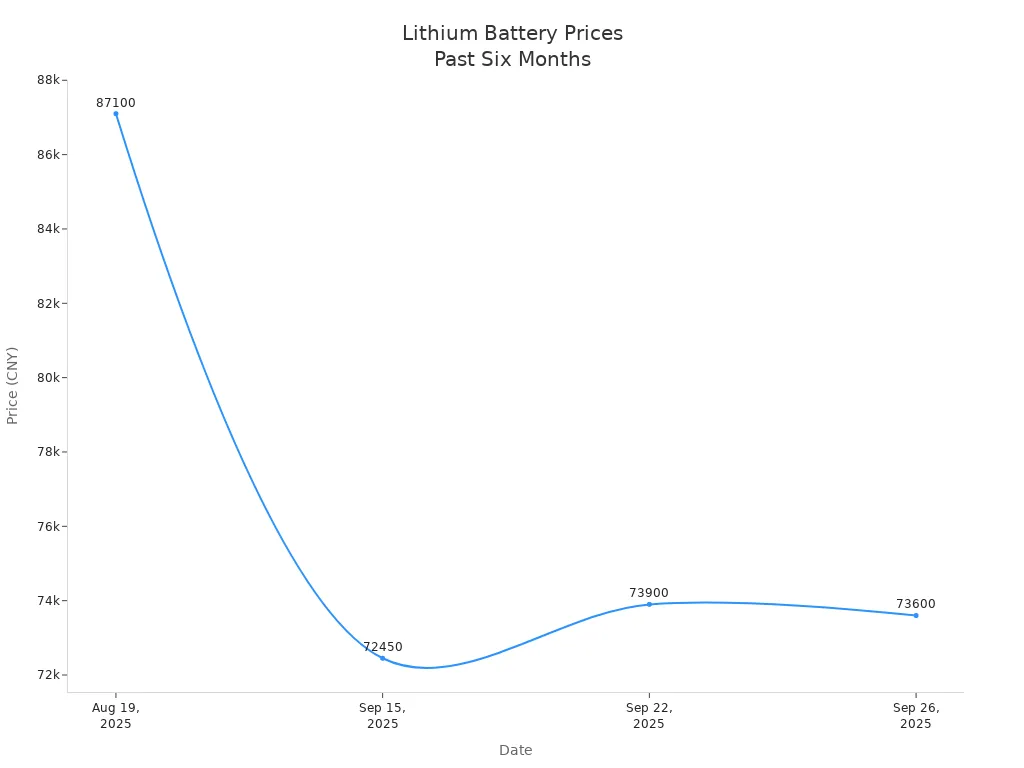

You can see how lithium battery price changes over the past six months in the table below:

| Date | Price (CNY) | Change (%) |

|---|---|---|

| August 19, 2025 | 87,100 | - |

| September 15, 2025 | 72,450 | - |

| September 22, 2025 | 73,900 | +2.00% |

| September 26, 2025 | 73,600 | -0.20% |

| Last Month Change | - | -9.79% |

| Yearly Change | - | -2.52% |

You observe that the price trend for lithium batteries can shift quickly. The chart above shows a sharp drop in price from August to September, followed by small fluctuations. These trends help you understand how market forces affect lithium battery price.

Year-on-Year Price Change

You see a clear downward price trend when you compare lithium battery price data year over year. The average price per kWh for lithium-ion batteries dropped by 20% from 2023 to 2024. This yearly price trend reflects improvements in manufacturing and increased supply.

You notice that the yearly change in lithium battery price is not always steady. The table above shows a -2.52% change over the past year. Factors such as raw material costs, demand for electric vehicles, and supply chain issues can cause price trends to shift.

You benefit from tracking these price trends. You can make better decisions about when to buy batteries for your projects. You also gain insight into how global events and market changes affect lithium battery price.

Tip: Stay updated on lithium battery price trends. You can use this information to plan purchases and investments more effectively.

Historical Price Trend

Decade-Long Price Decline

You can see how lithium battery prices have changed over the past decade. In 2010, a lithium battery pack cost about $1,436. Since then, prices have dropped by more than 75%. This steady decline has made batteries more affordable for electric vehicles, energy storage, and consumer electronics.

- 2024 saw the steepest annual decline in lithium-ion battery pack pricing since 2017.

- The average annual rate of decline has been significant, helping more industries use lithium batteries.

- Lower prices have supported the growth of electric vehicles and renewable energy.

You notice that these historical price trends have shaped the way you use technology today. Cheaper batteries mean you can access better devices and cleaner transportation.

Note: The ongoing drop in lithium battery prices is often called the "batteryification" of technology. This trend makes advanced energy solutions available to more people.

Key Events Impacting Price

Many events have caused big changes in lithium battery prices. You can see some of the most important factors in the table below:

| Factor | Description |

|---|---|

| Supply-Demand Imbalance | Demand for lithium has surged due to the EV market, while supply struggles to keep up. |

| Production Bottlenecks | Delays in expanding production in key regions because of regulations and local opposition. |

| Geopolitical Tensions | China's dominance in refining raises concerns about supply chain vulnerabilities. |

| Inflation | Higher costs for energy, labor, and transportation make lithium production more expensive. |

| Speculative Trading | Market sentiment and news can cause short-term price swings. |

You can use this table to understand why lithium battery prices sometimes rise or fall quickly. These events show how global markets, politics, and technology all play a role in shaping battery costs.

Factors Influencing Lithium Battery Prices

Understanding the factors influencing lithium battery prices helps you make smarter decisions in a changing market. You see how raw material costs, manufacturing advances, and policy impacts shape the price trend for rechargeable lithium batteries. Each factor plays a unique role in determining the average lithium battery cost and competitive pricing.

Raw Material Costs

Raw material costs drive the price of lithium batteries. You notice that lithium, cobalt, and nickel are essential for battery production. When the price of cobalt rises, the cost to produce Lithium Cobaltate increases. This can reduce supply and push up lithium prices. Fluctuations in these metals create a ripple effect across the market, affecting the overall cost of lithium-ion batteries.

You see that demand for electric vehicles and energy storage solutions puts pressure on raw material supplies. When demand spikes, prices for lithium and other metals often climb. If mining or processing slows down, costs rise quickly. You benefit from tracking these price trends because they help you predict when lithium battery price might change.

Tip: Watch for news about mining operations and metal prices. These updates can signal upcoming shifts in battery costs.

Manufacturing Advances

Manufacturing advances help lower the cost of lithium batteries. You see companies adopt new technologies to improve efficiency and reduce waste. For example, 3D current collectors boost battery performance without requiring major changes to production lines. This innovation supports competitive pricing and helps manufacturers stay ahead in the market.

Recent trends show that smarter manufacturing techniques allow Western producers to compete with lower-cost rivals. You notice that process optimization and material analysis prevent waste and ensure consistent quality. These advances make lithium battery price more affordable for consumers.

- Innovations in material analysis verify expensive battery materials, reducing costly waste.

- Process optimization streamlines production and maintains quality.

- Advanced manufacturing techniques, such as 3D current collectors, improve thermal management and charging speed.

- New chemistry compatibility expands battery applications and lowers costs.

You see that these factors drive down the average lithium battery cost and support broader use in electric vehicles, energy storage, and electronics.

Policy and Supply Chain

Government policies and supply chain disruptions have a strong impact on lithium battery price. You notice that laws like the Infrastructure Investment and Jobs Act and the Inflation Reduction Act provide subsidies for domestic battery production. These policies also impose tariffs on imported batteries, which can raise prices in the short term but encourage local supply and competition over time.

Supply chain disruptions, such as those caused by the COVID-19 pandemic, affect battery costs worldwide. Operational slowdowns in mining and processing lead to tighter supplies and higher prices. Geopolitical tensions and trade disputes complicate the supply chain, increasing production costs. You see that transportation challenges and delays can push up prices even more.

| Impact Description | Details |

|---|---|

| Operational Slowdowns | The pandemic slowed lithium mining and processing, leading to higher costs. |

| Geopolitical Tensions | Trade disputes raised production costs and affected supply reliability. |

| Consumer Impact | Increased costs made electric vehicles and energy storage less affordable. |

| Mining and Processing Disruptions | Lockdowns disrupted global mining and processing activities. |

| Transportation Challenges | Delays and higher transportation costs affected battery prices. |

| Price Increases | Some manufacturers saw up to 300% price increases for critical materials. |

You benefit from understanding these price drivers. When you follow policy changes and supply chain news, you can anticipate shifts in lithium battery price and plan your purchases accordingly.

Note: Monitoring trends in government policy and supply chain stability helps you stay ahead of market changes.

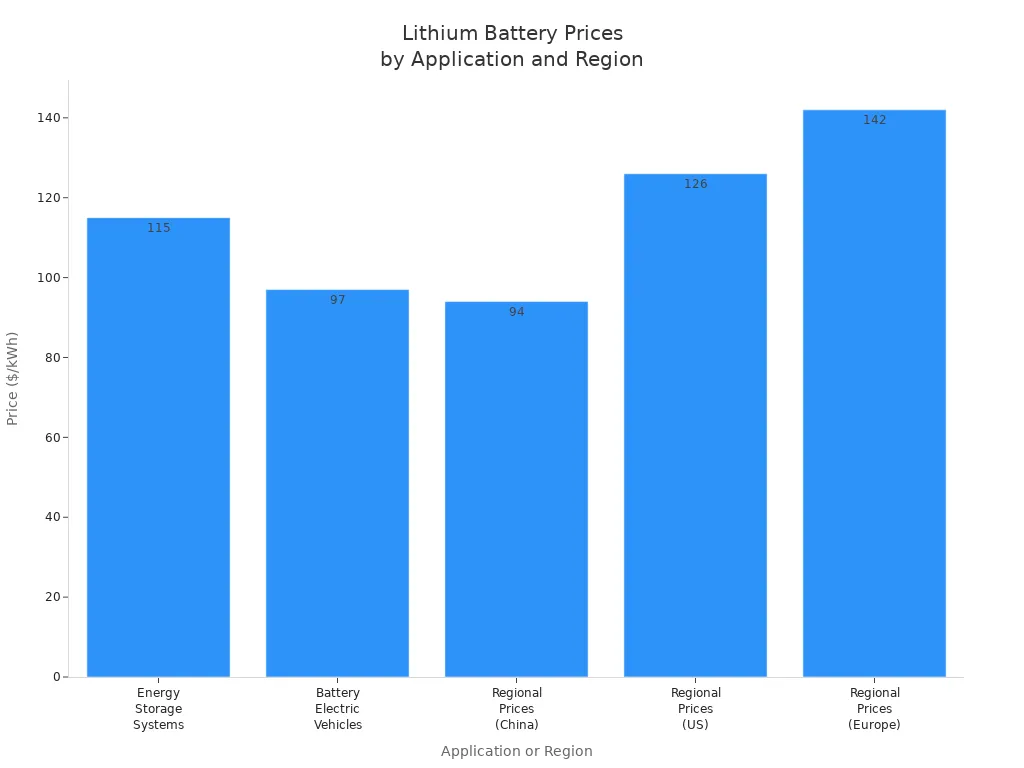

Lithium Battery Price by Application

Electric Vehicles

You see a major shift in the price of lithium power battery packs for electric vehicles. The average price per kWh for lithium-ion batteries used in EVs reached $115 in 2024. For the first time, the battery price for electric vehicles dropped below $100 per kWh in some markets. This change makes electric vehicles more affordable and boosts demand for clean transportation.

- The average price of lithium-ion battery packs for electric vehicles is USD 115 per kilowatt hour as of 2024.

The drop in lithium battery price comes from lower lithium costs and improved manufacturing. You notice that the electric vehicle battery cost now plays a smaller role in the total price of a new EV. In 2014, lithium-ion batteries cost $290 per kWh. By 2023, the price fell to $103 per kWh. This sharp decline in lithium power battery price helps you access more affordable electric vehicles.

Energy Storage

You see that storage applications also benefit from falling lithium battery price. The average price for lithium power battery packs in energy storage systems is $115 per kWh, a record low and down 20% from 2023. This drop supports the growth of renewable energy and grid storage projects.

| Application | Price ($/kWh) | Notes |

|---|---|---|

| Energy Storage Systems | 115 | Record low price, down 20% from 2023. |

| Battery Electric Vehicles | 97 | First time below $100/kWh. |

| Consumer Electronics | N/A | Prices not specified, but generally lower than energy storage and EVs. |

| Regional Prices (China) | 94 | Lowest average battery pack prices globally. |

| Regional Prices (US) | 126 | 31% higher than China due to production costs. |

| Regional Prices (Europe) | 142 | 48% higher than China, reflecting market maturity and costs. |

You benefit from lower lithium power battery price in storage. This trend makes large-scale storage more practical for homes, businesses, and utilities. You can now store solar or wind energy at a lower cost.

Consumer Electronics

You find that lithium battery price for consumer electronics is higher per kWh than for storage or EVs. Devices like smartphones and laptops use smaller lithium power battery packs, which cost more to produce per unit of energy. The typical cost per kWh for lithium batteries in consumer electronics ranges from $200 to over $1,000.

| Application / Sector | Typical Cost per kWh |

|---|---|

| Consumer Electronics | $200–$1,000+ |

You see that the higher price comes from the need for compact size, safety, and performance. Even with these higher costs, lithium power battery technology remains the top choice for portable devices. You rely on these batteries for daily use in phones, tablets, and laptops.

Tip: Review the battery price overview for each application before making a purchase. You can save money by choosing the right lithium power battery for your needs.

Regional Price Differences

Asia-Pacific

You notice that the Asia-Pacific region leads the world in lithium battery price reductions. In 2023, the average price for lithium-ion iron phosphate (LFP) cells reached USD 100 per kWh. This drop makes energy storage systems more affordable for homes and businesses.

- Technological advancements and increased investments drive down battery cost.

- Manufacturers in Asia-Pacific produce batteries at scale, lowering the price for EV and storage applications.

- You see more competitive pricing for lithium batteries in China, Japan, and South Korea.

The region’s focus on innovation helps you access lower-cost storage solutions. You benefit from the rapid decline in battery price, which supports the growth of renewable energy and electric vehicles.

Europe

You find that battery price in Europe remains higher than in Asia-Pacific. Several factors contribute to this difference:

| Factor | Description |

|---|---|

| Volatility of Battery Metals | Prices of lithium, cobalt, and nickel change quickly, affecting overall cost. |

| Demand for Electric Vehicles | High demand for EVs due to strict CO2 regulations increases battery price. |

| Human Rights Concerns | Issues with cobalt mining in the DRC raise costs and sourcing challenges. |

- The European market sees strong demand for lithium batteries, especially for EVs and storage.

- Stringent EU CO2 rules push manufacturers to use more batteries, raising price and cost.

- You notice that the market grows as more IoT devices require lithium battery storage.

You pay more for batteries in Europe because of these factors. The region’s focus on ethical sourcing and environmental standards also increases cost.

North America

You observe that North America offers competitive lithium battery price, though not the lowest globally. The average price per kWh for lithium batteries is projected to be around USD 82 by 2025.

- CATL ships LFP cells at $56 per kWh, showing a global drop in battery price.

- North America’s price remains higher than China’s lowest price but is much lower than past costs.

- Government incentives, such as tax credits, support domestic battery production and help lower cost over time.

- Tariffs on Chinese battery imports raise production costs for American manufacturers, affecting price and competitiveness.

- Trade agreements can stabilize lithium battery price by reducing tariffs and encouraging local storage production.

You benefit from these policies, which aim to make lithium battery storage more affordable and reliable. You see that regional price differences reflect local manufacturing, government action, and market demand.

Tip: Compare battery price and cost across regions before making a purchase. You can save money by choosing the right market for your lithium battery storage needs.

Battery Chemistry and Price

LFP vs. NMC

You often see two main types of lithium batteries: LFP (Lithium Iron Phosphate) and NMC (Nickel Manganese Cobalt). LFP batteries usually cost less and show more stable prices over time. NMC batteries, on the other hand, can change in price by 30-50% because the costs of nickel and cobalt go up and down. LFP batteries only shift in price by about 10-20%. This makes LFP a safer choice if you want to avoid big surprises in your budget.

Manufacturers like LFP batteries for their steady prices and good safety record. NMC batteries offer higher energy density, which means they store more power in the same space. You might choose NMC for electric cars that need to go farther on a single charge. If you want a battery that is more affordable and reliable, LFP is often the better pick.

Note: LFP batteries have become popular for home energy storage and city buses because of their lower cost and stable supply.

Emerging Chemistries

You see new battery chemistries entering the market. Solid-state batteries and sodium-ion batteries are two examples. Sodium-ion batteries use materials that are easier to find than lithium, which could make them cheaper in the future. Solid-state batteries remove flammable liquids, making them safer for you and your devices.

The price of a lithium-ion battery depends on its chemistry. LFP batteries cost less than nickel-rich types like NMC. In some places, prices for lithium-ion batteries range from $40 to $140 per kilowatt-hour. New chemistries like LMFP (Lithium Manganese Iron Phosphate) are also being tested, but they have not yet become common.

You benefit from these new options because they give you more choices for safety, cost, and performance. As technology improves, you can expect even more changes in battery prices and features.

Future Price Outlook

Short-Term Forecast

You can expect the price trend for lithium batteries to continue its downward movement over the next two years. Recent forecasts show that lithium battery prices will likely drop by 5-10% each year from 2024 to 2026. Manufacturing improvements and strong supply and demand dynamics drive these trends. You may see battery costs decrease as companies adopt new production methods and scale up operations. This short-term forecast suggests that you will benefit from lower prices if you plan to purchase lithium batteries soon.

Long-Term Forecast

Looking further ahead, you will notice even more dramatic changes in future price projections for lithium batteries. Industry experts predict that the average price per kWh will reach $100 or slightly below by 2025. By 2030, you could see prices fall to between $32 and $54 per kWh. The table below shows these long-term price trends:

| Year | Average Lithium Battery Price per kWh (USD) |

|---|---|

| 2025 | Projected $100 or slightly below |

| 2030 | Expected between $32 and $54 |

You can use this information to plan your investments and purchases. Lower costs will make electric vehicles and energy storage systems more accessible to you and your community.

Influencing Factors

Several factors will shape lithium battery price trends in the coming years. You should pay attention to these key influences:

- Raw material costs, especially for lithium, cobalt, and nickel, will affect battery prices as demand rises.

- Technological advancements can reduce production cost and improve efficiency.

- Market demand for electric vehicles and renewable energy storage will push prices higher.

- Supply chain resilience strategies can help stabilize cost and reduce market volatility.

- Recycling initiatives may recover valuable materials, offsetting raw material cost and stabilizing prices.

- Government policy, including subsidies and restrictions, can impact overall price trends.

You will see that global and local factors, such as shipping delays and new regulations, also play a role in shaping the market. As technology advances, you may benefit from lower costs, but new safety and sustainability standards could add to manufacturing expenses. Stay informed about these trends to make smart decisions and get the best value for your battery purchases.

Tip: If you have questions about lithium battery price trends or want advice on timing your purchase, leave a comment below. Your feedback helps improve future guides.

You see lithium battery prices dropping fast, with experts predicting costs below $100/kWh by 2027. Lower raw material costs and better production drive this trend. When you buy, consider these factors:

- Capacity and power output for your needs

- Manufacturer reliability and warranty

- Total cost of ownership, including recycling and maintenance

| Source | Frequency of Updates | Reliability |

|---|---|---|

| SFA | Quarterly | High |

Stay informed by joining industry forums and following market updates. Ask questions below to get advice tailored to your application.

-

May.2025.12.22What is a Nickel Cadmium Battery and How Does It WorkLearn More

May.2025.12.22What is a Nickel Cadmium Battery and How Does It WorkLearn More -

May.2025.12.22How to clean battery corrosion?Learn More

May.2025.12.22How to clean battery corrosion?Learn More -

May.2025.12.2021700 Battery: Meaning, Comparison with 18650, and How to Choose the Best QualityLearn More

May.2025.12.2021700 Battery: Meaning, Comparison with 18650, and How to Choose the Best QualityLearn More -

May.2025.12.19Medical Device 18650 Rechargeable Battery: What Buyers Must Evaluate?Learn More

May.2025.12.19Medical Device 18650 Rechargeable Battery: What Buyers Must Evaluate?Learn More -

May.2025.12.19Common voltage types of lithium polymer batteries for different applicationsLearn More

May.2025.12.19Common voltage types of lithium polymer batteries for different applicationsLearn More