Lithium-Ion Battery Price Predictions for the Coming Years

You can expect the lithium-ion battery price to continue dropping in the coming years, driven by rapid advances in technology and strong demand for clean energy. Understanding these trends helps you make smart decisions for planning and investment. Recent forecasts show the lithium-ion battery market could reach $189.4 billion by 2032, growing at a 15.2% rate.

| Aspect | Details |

|---|---|

| Market Size By 2032 | USD 189.4 billion |

| Growth Rate | CAGR of 15.2% |

| Forecast period | 2022 - 2032 |

| Key Market Players | CATL, Panasonic, LG Chem, Samsung SDI, BYD, and others |

| Market Segmentation | By Component, Capacity, Application, Region |

- The lithium ion battery price reflects both market growth and innovation.

- You will see major companies invest in better batteries and lower costs.

Key Takeaways

- Expect lithium-ion battery prices to continue dropping, making electric vehicles and energy storage more affordable.

- Monitor supply and demand changes, as they can quickly impact battery prices and market trends.

- Regional price differences matter; always compare local market conditions before making investments.

- Stay informed about new battery technologies and recycling methods, as they will shape future pricing and availability.

- Watch for opportunities in the growing market; lower prices will drive innovation and competition.

Lithium-Ion Battery Price Trends

Historical Declines

You have seen dramatic changes in lithium-ion battery price over the past decades. The average price of lithium-ion battery packs dropped by 85% from 2010 to 2018, reaching $176 per kilowatt-hour. This steep decline happened because manufacturers improved technology and increased production capacity. You can observe a learning rate of about 18%, which means every time the total volume doubled, the price fell by that percentage. In 1991, the price of lithium-ion battery cells was $7,500 per kilowatt-hour. By 2018, it had dropped to $181. Prices halved between 2014 and 2018, showing how quickly the lithium battery market responded to innovation and scale

Key drivers of historical declines:

- Advances in manufacturing processes

- Growth in production volume

- Lower material costs

- Increased demand for electric vehicles and energy storage

Recent Price Changes

You have witnessed even more rapid changes in the last two years. In December 2024, lithium-ion battery pack prices fell by 20% to a record low of $115 per kilowatt-hour. This was the largest annual drop since 2017. Manufacturing overcapacity, economies of scale, and a shift to lower-cost lithium-iron-phosphate batteries pushed prices down. Throughout 2024, lithium prices dropped sharply because the market became oversupplied. By November 2024, battery-grade lithium hydroxide reached its lowest price since 2017, at $8-9 per kilogram. Slowing demand for electric vehicles and cost pressures also contributed to these shifts.

Tip: You should watch for changes in supply and demand, as these can quickly affect lithium battery price and market trends.

Current Price Levels

You now see the average price per kilowatt-hour for lithium-ion batteries at $115 in 2024. This marks a 20% decrease from previous years. For electric vehicles, the price has dropped below $100 per kilowatt-hour for the first time. In China, prices are even lower, averaging $94 per kilowatt-hour. Prices in the US and Europe remain higher by 31% and 48%, respectively. The battery price trends show that regional differences matter when you plan investments or purchases.

| Region | Average Price (2024) |

|---|---|

| China | $94/kWh |

| US | $123/kWh |

| Europe | $139/kWh |

You can expect further decreases, with forecasts suggesting a drop of $3 per kilowatt-hour in 2025. The lithium-ion battery price continues to fall as technology improves and the lithium battery market grows.

Lithium-Ion Battery Price Forecast

2025 Projections

You can expect the lithium ion battery price to continue its downward trend in 2025. Most industry analysts agree that the average price will reach around $100 per kilowatt-hour or even slightly below. This drop reflects several important changes in the lithium battery market:

- Manufacturers have increased production, making batteries more affordable.

- Raw material costs have decreased due to better supply and recycling.

- Competition among battery makers has intensified, especially in Asia.

You will see these factors combine to push the lithium-ion battery price lower. The demand for electric vehicles and energy storage systems keeps growing. As a result, the lithium battery price becomes more competitive, helping more people and businesses adopt clean energy solutions.

2030 Outlook

Looking ahead, you will notice even more changes in the long-term market outlook for lithium-ion batteries. Experts predict that by 2030, the price per kilowatt-hour will fall to between $80 and $90. This forecast comes from improvements in technology, recycling, and a more stable supply chain. You can see the expected price changes in the table below:

| Year | Price per kWh Forecast | Notes |

|---|---|---|

| 2024-2025 | Below $100 | Increased production efficiency and a mature supply chain. |

| 2026-2027 | Initial spike | Rise of solid-state technology may increase costs initially. |

| 2028-2030 | $80-$90 | Stabilization due to a regulated market and effective recycling efforts. |

You should pay attention to the possible spike in price around 2026 and 2027. New solid-state battery technology may cost more at first. However, as the technology matures, the lithium-ion battery price will likely stabilize and continue to decrease.

Key Influencing Factors

Many factors will shape the future of lithium battery price. You need to understand these drivers to make informed decisions:

- Raw material costs make up 40–60% of the total battery price. Prices for lithium, cobalt, nickel, and graphite can change quickly.

- Government policies, such as subsidies or new regulations, can lower or raise costs. For example, U.S. tax credits and European Union compliance rules affect the lithium-ion battery price.

- Supply chain disruptions, like those caused by global events or shipping delays, can increase the lithium battery price.

- Advances in energy density help lower costs. A 10% improvement in battery energy density can reduce the price by $15–20 per kilowatt-hour.

- Competition among manufacturers, especially from China, drives prices down.

- Recycling potential is growing. By 2030, direct recycling and urban mining could cut material costs by 30%.

- Geopolitical factors, such as control over resources and trade policies, create uncertainty in the lithium battery market.

You will also see new trends in technology. Solid-state batteries and better recycling methods will make lithium-ion batteries safer and more efficient. The global battery raw materials market is expected to grow from about $53.55 billion in 2023 to $95.75 billion by 2030. This growth comes from rising demand, especially for electric vehicles. As a result, raw material costs may rise, which could impact the lithium ion battery price.

Note: You should watch for changes in demand, technology, and policy. These factors can quickly change the lithium-ion battery price and shape the future of the market.

Regional Lithium Battery Price Differences

You will notice that lithium-ion battery price varies greatly depending on the region. These differences come from local production costs, government policies, and the level of competition in each market. The table below shows how price characteristics differ across Asia, North America, and Europe:

| Region | Price Characteristics |

|---|---|

| Asia | Lowest prices globally; Chinese battery packs cost 31% less than those in the U.S. |

| Europe | Higher prices due to labor costs and regulations; recent increases influenced by raw material costs. |

| North America | Prices higher than Asia but lower than Europe; fluctuations due to EV demand and federal incentives. |

Asia-Pacific

You see the lowest lithium-ion battery price in the Asia-Pacific region. The average price for lithium iron phosphate cells stands at about $100 per kilowatt-hour as of 2023. Several factors drive this low price:

- Rapid advancements in battery technology

- Large-scale manufacturing capabilities

- Strong government support for renewable energy

- Intense competition that leads to economies of scale

China leads the lithium battery market, offering battery packs at prices much lower than other regions. This advantage helps the region dominate global supply and keeps the lithium battery price competitive.

North America

In North America, you face higher prices than in Asia but lower than in Europe. The projected price for 2025 is $144 per kilowatt-hour. Several reasons explain this difference:

- Regional production dynamics affect supply and cost

- Battery chemistries used in the U.S. often cost more

- Tariffs and trade regulations impact the final price

You also see price fluctuations because of changing demand for electric vehicles and the effect of federal incentives. The lithium-ion battery price in North America reflects both local challenges and global trends.

Europe

Europe has the highest prices for lithium-ion batteries among the three regions. Labor costs and strict regulations push the price up. Recent increases in raw material costs have also affected the market. The projected price for 2025 in Europe is $123 per kilowatt-hour, which is still higher than in China. You will find that European manufacturers focus on quality and sustainability, which can add to the cost. The lithium-ion battery price in Europe often reflects these priorities.

Tip: If you plan to invest in lithium-ion batteries, always compare regional prices and consider local market conditions. This approach helps you make better decisions and manage costs.

Battery Pack Prices and Applications

Electric Vehicles

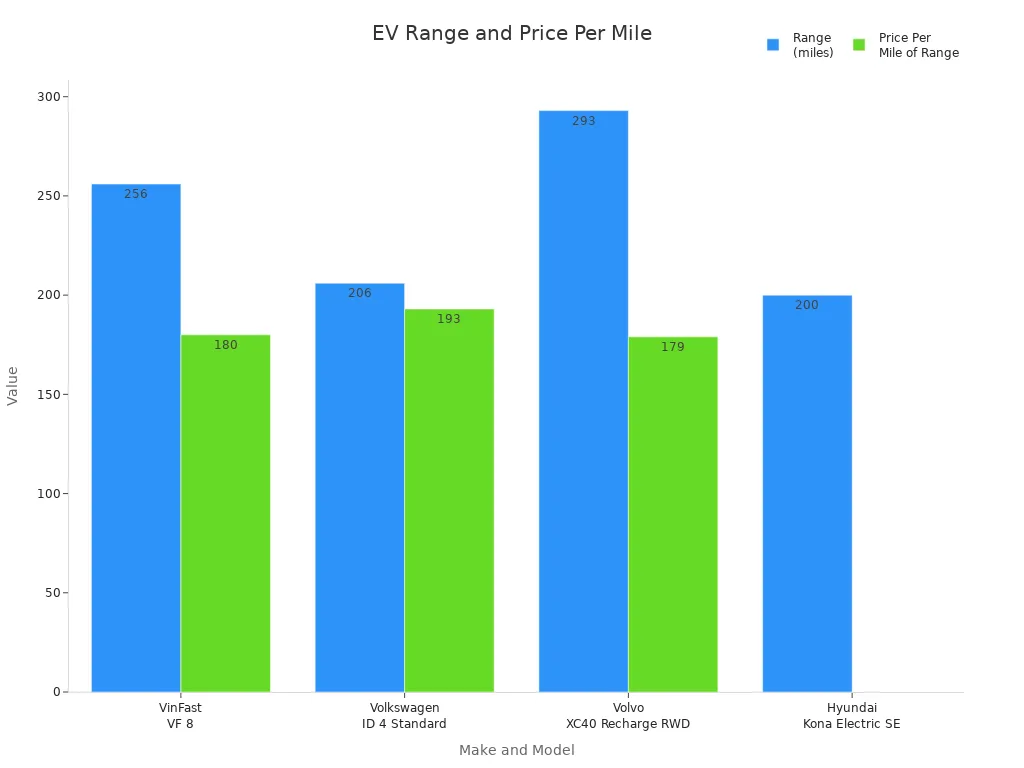

You see battery pack prices play a major role in the cost of battery electric vehicles. The electric vehicle battery cost can range from $4,760 to $19,200, depending on the model and battery size. This price affects the final sticker price and the price per mile of range. When you compare models, you notice differences in range and cost. The table below shows how battery pack prices impact popular EVs:

| Make and model | Range | Base Price (MSRP) | Price Per Mile of Range |

|---|---|---|---|

| VinFast VF 8 | 256 | $46,000 | $180 |

| Volkswagen ID 4 Standard | 206 | $39,735 | $193 |

| Volvo XC40 Recharge RWD | 293 | $52,450 | $179 |

| Hyundai Kona Electric SE | 200 | $32,875 | N/A |

You notice that lower battery pack prices help boost electric vehicle sales growth. In North America, supply issues sometimes slow down adoption, but the lithium-ion battery price continues to drop. As the average battery pack prices fall, you see more demand for batteries and a growing market for battery electric vehicles.

Energy Storage

Battery pack prices also shape energy storage applications. You see more households and businesses invest in battery energy storage systems as prices decrease. In Germany, many homes install batteries with solar panels. Lower lithium battery price encourages this trend, but the initial cost for storage remains high. The average lithium battery price for energy storage applications is still around 1,000 euros per kilowatt-hour. Financial factors, especially upfront costs, influence your decision to adopt these systems. As lithium demand rises, you can expect further price drops and wider adoption.

- Lower battery pack prices drive growth in energy storage applications.

- High initial costs can slow adoption, but yearly price trend shows improvement.

Consumer Electronics

You benefit from falling battery pack prices in consumer electronics. Over the past 30 years, the cost of lithium-ion batteries dropped by 99%. Energy density increased fivefold, making devices lighter and longer-lasting. By 2030, you can expect the lithium ion battery price for consumer electronics to reach $32 to $54 per kilowatt-hour. The lithium battery market continues to innovate, and the average lithium battery price drops with each doubling of production. This trend supports strong demand and better products.

| Metric | Value |

|---|---|

| Cost Reduction Over 30 Years | 99% decrease |

| Energy Density Increase | Fivefold increase |

| Projected Cost by 2030 | $32 to $54 per kWh |

| Cost Reduction per Doubling | 19% decrease |

| Density Gain per Doubling | 7% increase |

Tip: You should watch battery pack prices closely. Lower prices mean more affordable EVs, better energy storage, and improved consumer electronics.

Technology and Market Dynamics

New Battery Chemistries

You see new battery chemistries changing the future of the lithium-ion battery price. Manufacturers now use LFP (lithium iron phosphate) batteries, which remove nickel, manganese, and cobalt. This change can lower manufacturing costs and make batteries safer. Chinese companies have scaled up production, leading to full-cycle costs that are 50% lower than in the West. You also notice predictions that energy density could double by the 2030s, which will affect both price and performance. The table below compares some of the latest battery chemistries and their impact on price trends:

| Evidence Type | Description |

|---|---|

| LFP Battery Chemistry | LFP batteries eliminate the use of nickel, manganese, and cobalt, potentially reducing manufacturing costs. |

| Chinese Manufacturing Scale-up | The scale-up of Chinese manufacturing can lead to significant cost reductions, with full-cycle costs being 50% lower than in the West. |

| Future Energy Density | Predictions indicate that the energy density of lithium-ion batteries could double by the 2030s, influencing pricing dynamics. |

You also see sodium-ion batteries gaining attention. These batteries use sodium, which is more abundant and less expensive than lithium. By the 2030s, sodium-ion batteries may reach cost-competitiveness with lithium-ion. This shift could further influence the lithium ion battery price and make EVs more affordable.

Recycling and Second-Life Use

You play a key role in the growth of battery recycling and second-life use. As more EVs reach the end of their first life, the number of used batteries available for repurposing will exceed 17 GWh by 2030. This trend helps stabilize the supply of raw materials and can reduce the lithium battery price. Consider these important points:

- Battery costs make up nearly 40% of total EV costs, so recycling can lower overall price.

- Lithium prices have surged over 1,000% since 2020, which has pushed up battery pack prices.

- The demand for EVs drives up raw material prices, but recycling and second-life applications help stabilize supply and control price increases.

- Policies that support sustainable energy storage encourage the growth of second-life battery markets.

- Collaboration between automakers, battery manufacturers, and energy companies is essential for a healthy market.

You benefit from these changes because they help keep the lithium-ion battery price more stable and predictable.

Supply Chain Shifts

You see major shifts in the supply chain affecting the lithium-ion battery price. Export prices for lithium-ion batteries dropped from $32.9 per kilogram in 2020 to $20.1 in 2024. Battery prices in China are now 30% lower than in Europe and 20% lower than in North America. The increase in U.S. lithium-ion storage projects links directly to the decline in Chinese export prices. China’s large export capacity shapes global prices and supports the growth of EV and energy storage projects worldwide.

Note: You should pay attention to supply chain dynamics. Changes in the chain can quickly impact the price you pay for lithium-ion batteries and the overall market.

Implications for Stakeholders

Consumers

You benefit directly from falling lithium-ion battery price trends. Lower prices make electric vehicles and electronics more affordable. You see battery pack costs for EVs drop from $290 per kWh in 2014 to $115 per kWh in 2024. Some markets now offer prices below $100 per kWh. This means you can consider buying an EV or upgrading your devices without worrying as much about high costs. Energy storage systems also become more accessible, with battery pack prices at a record low of $115 per kWh, down 20% from last year. For consumer electronics, prices remain higher, ranging from $200 to over $1,000 per kWh, but you can expect more competitive pricing soon.

- You have more choices for affordable EVs.

- You see better access to home energy storage.

- You notice electronics with longer battery life and lower costs.

Tip: Watch for new models and deals as manufacturers pass savings on to you.

Industry

You face new challenges and opportunities as lithium-ion battery price trends shift. Supply chains must adapt to changing materials and global events. Extreme weather can disrupt infrastructure. Geopolitical tensions affect mineral supply and trade. Corporate consolidation increases the impact of disruptions. Changing materials alter supply chain dependencies. You see the transition to EVs create new jobs in battery manufacturing, while traditional automotive roles may decline. Companies like Tesla and Rivian show how startups can thrive. Localizing the EV battery supply chain attracts investment and supports local economies.

| Factor Affecting Supply Chain | Implication |

|---|---|

| Extreme Weather | Disrupts infrastructure and energy inputs |

| Geopolitics | Affects mineral supply and trade relations |

| Corporate Consolidation | Increases impact of disruptions |

| Changing Materials | Alters supply chain dynamics and dependencies |

- You can invest in new technologies and local production.

- You must plan for supply chain risks and adapt quickly.

Investors

You see strong opportunities as the market expands. The decline in lithium-ion battery price boosts adoption in EVs and energy storage. You can expect more funding and new entrants in the market. Lower prices encourage growth and innovation. You may find new startups and established companies competing for market share. As the market grows, you can diversify your investments and support sustainable technologies.

Note: You should monitor price trends and market forecasts to identify the best investment opportunities.

You see lithium-ion battery prices dropping fast, with a 50-60% decrease in China since 2022 and lithium prices falling 86%. This trend makes electric vehicles and energy storage more affordable. The market could reach $393.6 billion by 2035. You should watch for new battery chemistries, solid-state advances, and second-life uses. Second-life batteries help stabilize supply and lower costs. Second-life applications grow as more batteries reach end-of-life. Second-life solutions support recycling and sustainability. Second-life strategies help businesses manage costs. Second-life options give consumers more choices. Second-life markets attract investors. Second-life technology drives innovation. Second-life adoption boosts energy storage. Second-life batteries shape the future. Stay alert to second-life trends and ongoing changes.

-

May.2026.01.20A&S Power Technology Co., Limited Exhibits at Tokyo Big Sight 2026Learn More

May.2026.01.20A&S Power Technology Co., Limited Exhibits at Tokyo Big Sight 2026Learn More -

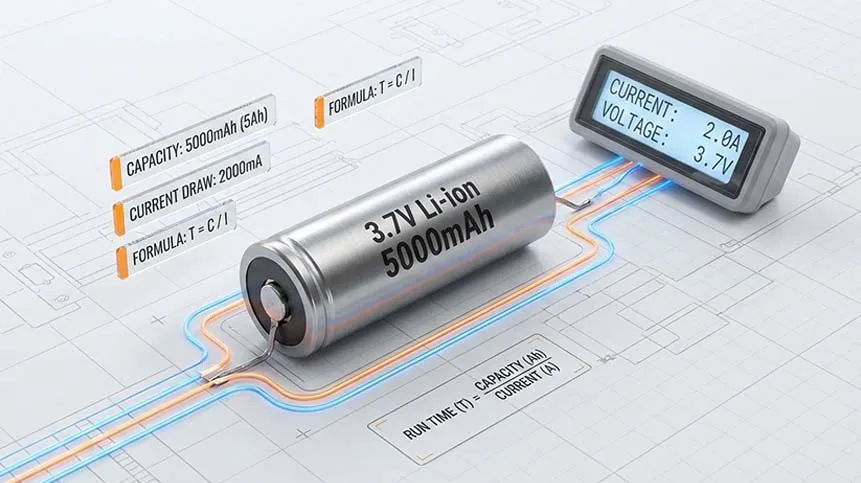

May.2026.01.19How to Calculate Battery Run Time?Learn More

May.2026.01.19How to Calculate Battery Run Time?Learn More -

May.2026.01.19What Is Better, Lithium Ion or Polymer?Learn More

May.2026.01.19What Is Better, Lithium Ion or Polymer?Learn More -

May.2026.01.19What Is a Rechargeable Li-ion Battery: Complete Guide & Industry InsightsLearn More

May.2026.01.19What Is a Rechargeable Li-ion Battery: Complete Guide & Industry InsightsLearn More -

May.2026.01.16Lithium Manganese Dioxide Battery Ultimate GuideLearn More

May.2026.01.16Lithium Manganese Dioxide Battery Ultimate GuideLearn More